epf employer contribution rate 2019

Hike in EPF Interest Rates 2018-19. In early 2019 I registered myself for EPF i-Saraan previously known as 1Malaysia Retirement Savings Scheme or SP1M.

Employees Provident Fund Or Epf Rules For Employer

However as per the announcements made in the Union Budget 2019 the NPS corpus that can be withdrawn at the time of retirement ie 60 of the total accumulated corpus would be tax-exempt from FY 2020-21.

. The EPF interest rate for FY 2018-2019 is 865. Can an employee opt out from the Schemes under EPF Act. As mentioned earlier interest on EPF is calculated monthly.

As of now the EPF interest rate is 850 FY 2019-20. In March 2022 the EPFO lowered the interest rate on employee provident funds to 810 for 2021-22The EPFO lowered the interest rate of 810 for the fiscal year of 2021-22. Employees EPF contribution rate.

Then enter your contribution and employers contribution to the Provident Fund. V The employees will be obligated to deposit their matching contribution for the past period ie. On January 1 of each year the taxable wage cap changes.

In the event you are looking for ERP system with an affordable HR Payroll read this HR Payroll for Malaysia. EPF Interest Rates FY 2021-22. With the EPF contribution rate of between 7 to 11 employee and 12 or 13.

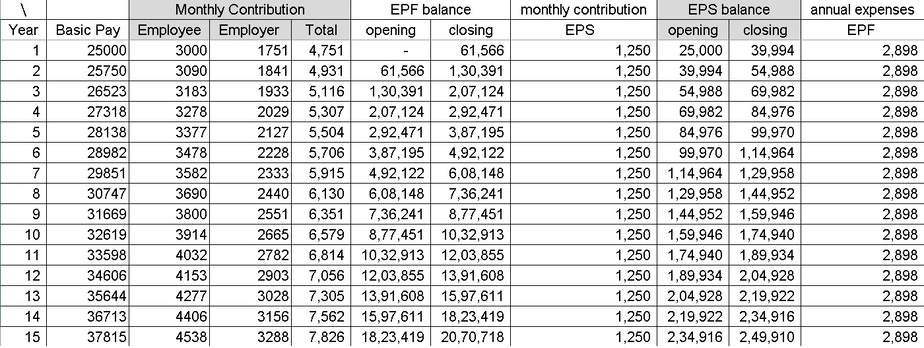

Malaysian age 60 and above. In Many Companies Employee and Employer are Paying PF on higher amount of 20000 Employee Contribution EPF12 200002400 Employer Contribution EPS833150001250 Difference2400-12501150 Total Employer PF125011502400 Note- Even if PF is calculated at higher amount For EPS we will take 15000 limit only. The total EPF contribution for April will be Rs 2194.

The employer must pay their employees contributions on or before the 15th of the following wage month. A 10 rate is applicable in the case of establishments with less than 20 employees. Revised EPF Interest Rate for 2019-20.

EPF Contribution by Employee and Employer. But this rate is revised every year. On 30 August 2022 EPFO proposed to remove the restrictions on the wage ceiling and headcount to allow all formal workers and self-employed to enrol in its retirement.

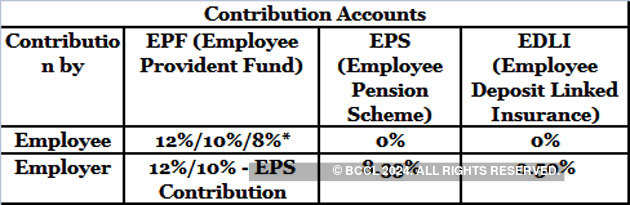

The contributions made by employer and employee towards the EPF account is the same. From the employers share of contribution 833 is contributed towards the Employees Pension Scheme and the remaining 367 is contributed to the EPF Scheme. Depending on the entity contributing towards EPF there are two components.

December 12 2021 at 943 pm. You can also check the past changes in historical EPF interest rates. Since 2020 the default.

The contribution rate for employers varies from 010 to 075. EPF Contribution for employees who have joined on or after 1st April 2016 with a salary up to Rs 15000 per month will also be. Employees Provident Fund EPF 367.

As per latest EPF rules the employee contribution is 12 of Basic Pay Dearness Allowance. Your employers contribution to your EPF is also tax-free. 1 Pre - Qualification bid opening on 11062019 at 1200 Noon 2 Technical bid opening on 12062019 at 0300 PM 3 Financial bid opening on 19062019 at 1100 PM.

The FY 2021-22 EPF interest rates are as per the date March 12 2022 EPF Contribution Rate FY 2021-22. Members of the Employees Provident Fund EPF are unable to view interest credits of 81 for 2021-22 in their retirement savings accounts due to a software upgrade to ring in a tax on PF. This is because calculations related to retirement corpus is dependent on EPF contributions and its interest rate.

Lets use this latest EPF rate for our example. Standard Employer EPF Rate is 13 if the Salary is less than RM5000 while 12 if the Salary is more than RM5000. So the interest rate applicable for each month is.

As of 2019 employers are not required to complete an employer portion of the application. Foreign workers are protected under SOCSO as well since January 2019. However this 12 is further subdivided into.

The interest rate is 81 for FY 2022-23. The interest rate is regulated every year by the Central Government of India. RFP for selection of Portfolio Managers.

January 2017 to December 2019 within a period of 12 weeks along with interest 6 pa after the contribution of the Company has been remitted to the PF Trust. 12 Employers contribution includes 367 EPF and 833 EPS. If you are interested to know the calculation of the EPF contribution formula you have came to the right place.

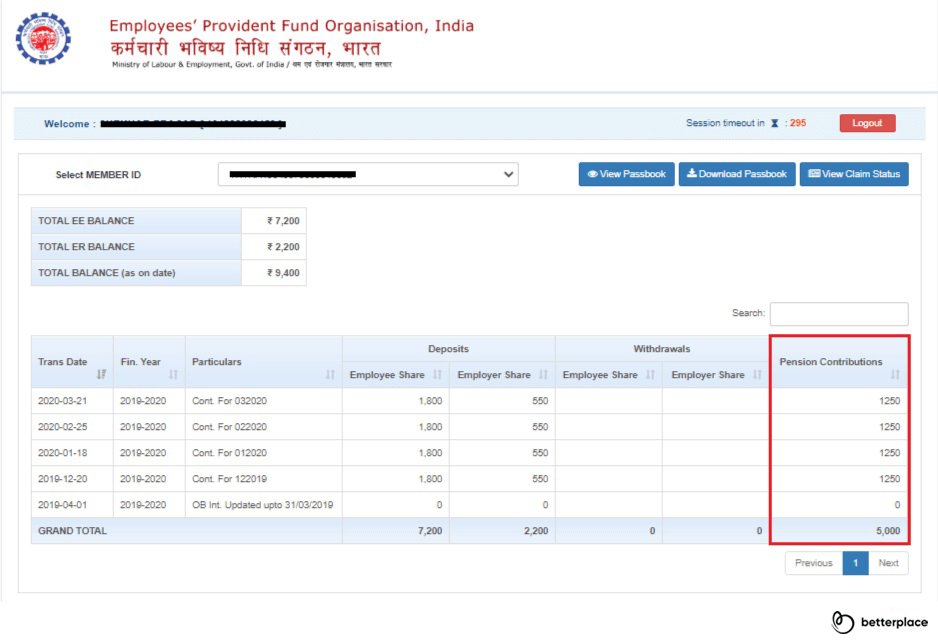

The decrease in interest rate will be a big blow to salaried individuals. Payment of 85 interest to around 6 crore EPF subscribers with the onset of the year 2021. The total contribution by the employer and employee towards the EPF account of the employee Rs 1680 Rs 514 Rs 2194.

Employers contribution towards Employees Deposit-linked Insurance Scheme is 050 and the administrative charges are 050. If we give UAN id and member id to new employer then he can see PF contribution amount and amount available in PF account. Employee Pension Scheme EPS 833.

233 thoughts on Can My New Employer Check My Previous EPF Deductions. 6 Ref Contribution Rate Section C Non-Malaysians registered as member from 1 August 1998. The employer only has NJ Earned Sick Leave that is compliant with the law.

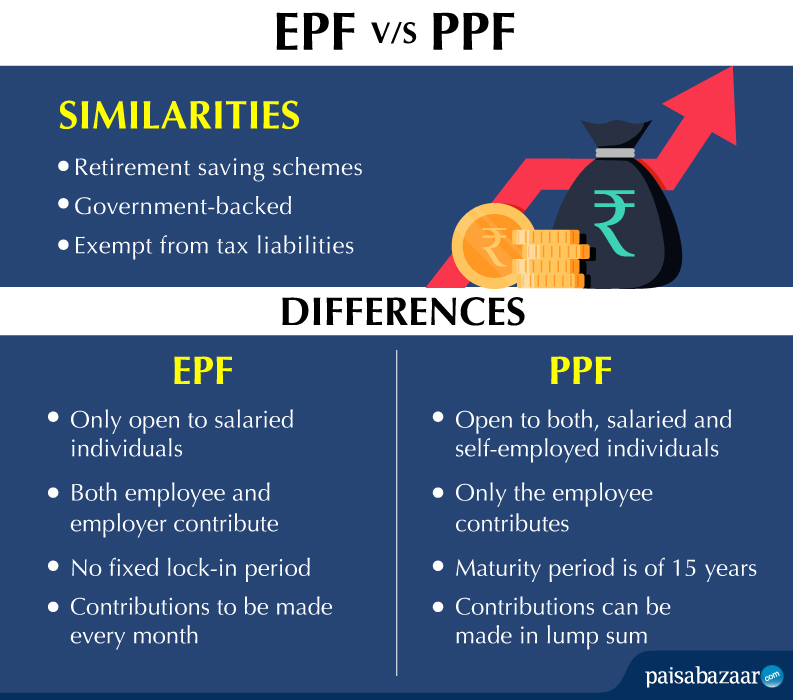

And the best part is that the money that you. The Labour Ministry has recently proposed to slash the interest rate by 04 to 81 from 85 earlier for the FY 2021-22. EPF vs PPF Interest Rate 2019.

In each PPO the first five digits indicate the code number of PPO Issuing Authority next two digits indicate the year of issue and after this the four digits indicate the sequential number of the PPO while the last digit is a check digit for the purpose of. The move makes NPS at par with other saving schemes such as PPF and EPF in terms of tax treatment. Employers EPF contribution rate.

Contribution by an employer -The contribution made by the employer is 12 of the basic salary of the employee. Effective from 1 January 2019 to March 2020 January 2019 salarywage up to March 2020. The interest rate for the scheme has been revised and lowered by 015 for the.

Employers contribution towards EPF Employees contribution Employers contribution towards EPS 550. Finally enter the current interest rate. The Government will make the employer contribution of 12 EPF and EPS both for the first three years of employment.

The following table shows the monthly contribution. Assuming the employee joined the Firm XYZ in April 2019. Monetary payments that are subject to SOCSO contribution are.

The Union Labour Minister Santosh Gangwar announced the new interest rates for EPF on 3rd March 2020. Key Points about EPF Contribution. Theyll detect when receiving the EPF statutory contribution from the employer under statutory contribution and thus no longer on i-Saraan.

Ways to check pension status on EPFO portal The following system is adopted for the allotment of 12 digits PPO numbers. Revised EPF Interest Rate for 2019-20. The interest earned on the EPF Account balance every year is tax-free.

Contribution by an employee Contribution towards EPF is deducted from the employees salary. EPF Interest Rate - Interest rate of EPF is reviewed every year after consultation with the Ministry of Finance by EPFOs Central Board of Trustees.

Epf Scheme Epfo Structure Applicabilty Functions Services Tax2win

Epfo Audit Shows Serious Gaps In Management Of Provident Fund Accounts Business Standard News

Labour Law Advisor On Twitter Here S Epf Contribution Rates November 2019 Epf Pf Pfcontribution Epfcalculation Pfcalculation Pensioncontribution Pension Epfo Https T Co 1px3uvqnjj Twitter

Epf Balance How To Calculate Employees Provident Fund Balance And Interest

Differences Between Epf And Ppf That You Must Know About

The Ultimate Showdown Cpf Sg Vs Epf My Vs Mpf Hk Vs 401k Usa

How To Calculate Interest On Your Epf Balance Mint

Post Budget Tax Math Should You Shift From Epf To Nps Now Mint

Epf Contribution Rate For Employee And Employer In 2019 Planmoneytax

Higher Epf Contribution On Basic Allowances Calculate Increase In Epf Corpus

Can We Withdraw Both Employee Plus Employer Contribution From Pf During Coronavirus Where Indian Govt Has Given Special Permission To Withdraw 75 Of Epf Balance Or We Can Just Withdraw From Employee

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

How Epf Employees Provident Fund Interest Is Calculated

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Eps Employee Pension Scheme Eligibility Calculation Withdrawal

The State Of The Nation When A Rm4 900 Monthly Wage Puts You Among Epf S T20 Members The Edge Markets

Epf Calculator How To Calculate Pf Amount For Salaried Employers

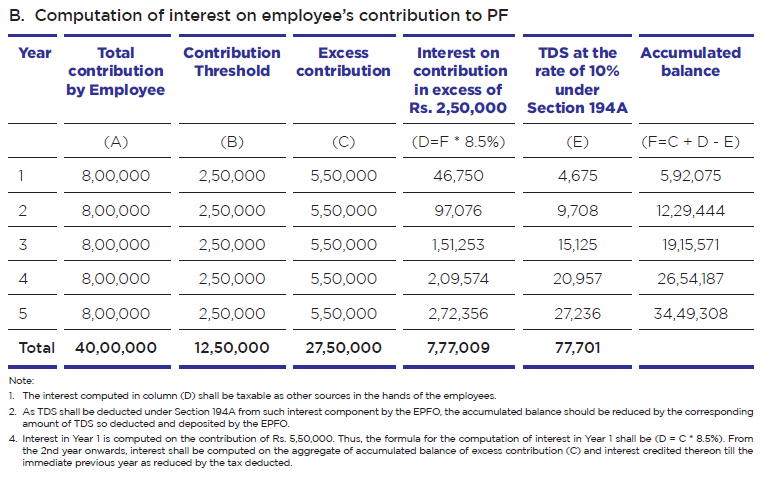

Tax On Interest Earned On Pf A Shot Hits The Bull S Eye Taxmann Blog

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird

0 Response to "epf employer contribution rate 2019"

Post a Comment